World’s Largest Warehouse Company in 2025 - Prologis Leads the Global Rankings

Warehouse Company Comparison Tool

Compare Warehouse Companies

Select two companies to see their key metrics side by side.

Comparison Results

Select Company 1

Revenue (2024)

-

Rentable Space

-

Number of Facilities

-

Countries Served

-

Select Company 2

Revenue (2024)

-

Rentable Space

-

Number of Facilities

-

Countries Served

-

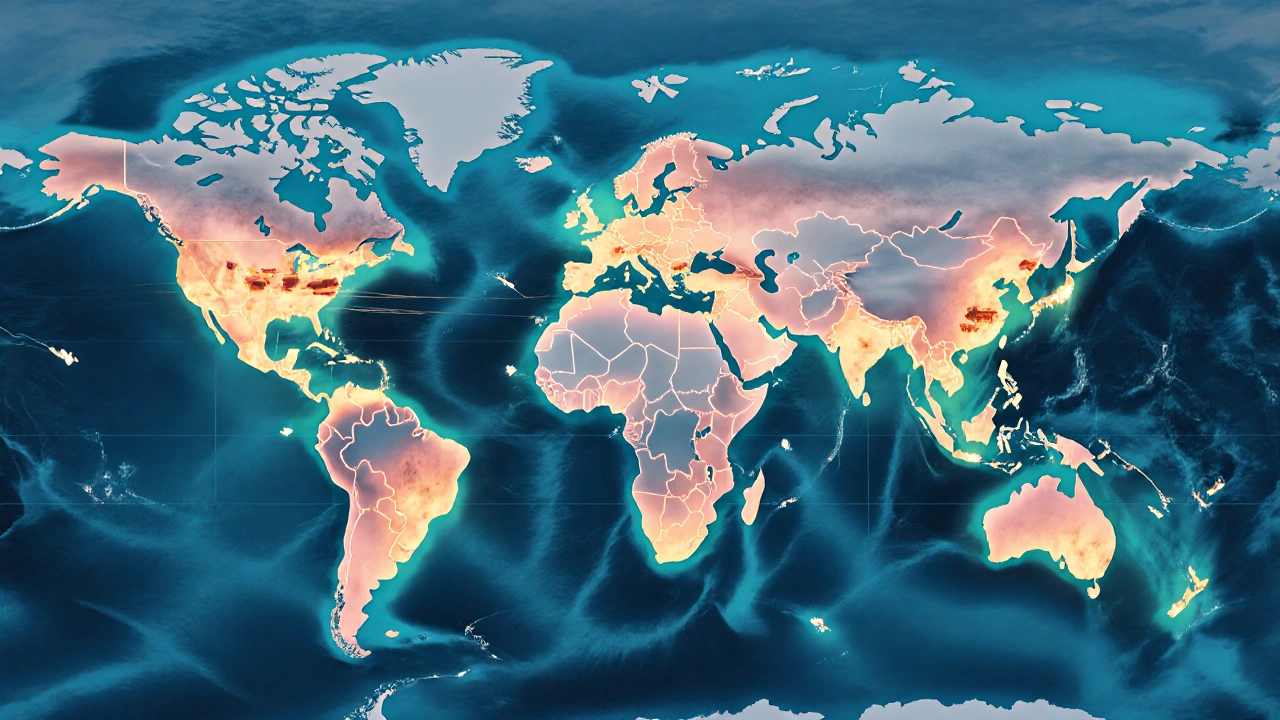

When you ask yourself which firm controls the most storage space on the planet, the answer points straight to one name: largest warehouse company. In 2025 that title belongs to Prologis, a real‑estate investment trust that develops, owns, and operates industrial logistics facilities across six continents. This article breaks down why Prologis sits at the top, how the ranking is calculated, and what the next‑biggest players look like.

How we measure “biggest” in the warehouse world

Size can be counted in many ways, but the industry typically looks at four hard metrics:

- Revenue - total income from leasing, management fees, and related services.

- Square footage - net rentable space measured in millions of square feet.

- Number of facilities - individual warehouses or distribution centers under a single corporate umbrella.

- Geographic footprint - countries and key trade lanes covered.

These figures are publicly disclosed in annual reports, SEC filings, and third‑party market analyses. By aligning them in a single table we can see which firms truly dominate the market.

Prologis - the clear leader

Prologis reported $20.5 billion in revenue for fiscal year 2024, manages roughly 1,000 warehouses, and offers over 1.1 billion square feet of rentable space. Its properties sit in more than 19 countries, with a heavy focus on North America, Europe, and emerging markets in Asia‑Pacific. The company’s growth strategy mixes new builds, strategic acquisitions, and joint ventures that let it tap local demand quickly.

Key drivers behind Prologis’ size include:

- Strong relationships with global e‑commerce giants who need fast‑lane distribution.

- Investment in automation - robot‑guided pallets, AI‑driven slotting, and cloud‑based warehouse management systems.

- Commitment to sustainability - over 30% of its portfolio is certified LEED Gold or higher.

Because of these factors, Prologis not only owns the most space but also captures the highest lease rates per square foot.

Other top global warehouse operators

While Prologis leads the pack, a handful of rivals also control massive networks. Each of them brings a unique angle that makes them attractive to different kinds of tenants.

GLP is a Singapore‑based developer that occupies the second spot by square footage, with roughly 1.2 million m² of space across 20 countries. GLP leans heavily on technology platforms that enable real‑time inventory visibility for its tenants.

DHL Supply Chain operates a logistics services arm that includes owned and managed warehouses, especially in Europe and South America. Its strength lies in integrated value‑added services such as pick‑pack, reverse logistics, and temperature‑controlled storage.

XPO Logistics merged its contract logistics business with its warehouse network in 2023, creating a hybrid model that blends transportation and storage. XPO’s footprint is strongest in North America, where it serves the retail and automotive sectors.

Kuehne+Nagel remains a global freight forwarder that also runs a sizable warehouse division, particularly for pharma and life‑science clients. Its facilities are known for high security and compliance standards.

Side‑by‑side comparison of the five biggest players

| Company | Revenue (2024) | Rentable Space | # of Facilities | Countries Served |

|---|---|---|---|---|

| Prologis | US$20.5 B | 1.1 Bn sq ft | ≈1,000 | 19 |

| GLP | US$9.8 B | 1.0 Bn sq ft | ≈850 | 20 |

| DHL Supply Chain | US$8.2 B | 850 M sq ft | ≈700 | 24 |

| XPO Logistics | US$7.4 B | 720 M sq ft | ≈650 | 12 |

| Kuehne+Nagel | US$6.9 B | 600 M sq ft | ≈500 | 22 |

The table highlights why Prologis stays ahead: higher revenue, more space, and a broader country presence. Yet each competitor carves out niches that matter to specific shippers.

What really makes a warehouse company "big"?

Beyond raw numbers, size reflects strategic capabilities:

- Tenant diversity - serving e‑commerce, automotive, pharma, and FMCG reduces reliance on a single market.

- Technology stack - WMS integrations, IoT sensors, and predictive analytics boost space utilization.

- Flexibility - ability to lease short‑term, provide customized racking, or scale quickly.

- Sustainability - green roofs, solar panels, and carbon‑neutral operations attract ESG‑focused customers.

When you evaluate a warehouse provider, look for a blend of these qualitative factors plus the quantitative metrics listed earlier.

Checklist for selecting a warehouse partner

Use the following quick reference when you start a search:

- Confirm the provider’s total rentable space meets your growth projections.

- Verify the geographic coverage aligns with your supply‑chain routes.

- Ask for case studies that show automation ROI and order‑to‑ship cycle reductions.

- Check ESG certifications - LEED, BREEAM, or ENERGY STAR.

- Review the pricing model - per‑square‑foot, per‑pallet, or service‑bundled rates.

Cross‑checking these items against the data in the comparison table will help you avoid hidden costs and ensure the partner can keep up with demand spikes.

Future trends that could reshuffle the rankings

The warehouse landscape isn’t static. Three forces are likely to shift the balance of power in the coming years:

- Hyper‑local fulfillment - Retailers are building micro‑fulfillment centers in city centers, which could boost providers with dense urban footprints.

- Robotics and AI - Companies that invest heavily in autonomous picking will achieve higher throughput per square foot, potentially shrinking the need for raw space.

- Regulatory pressure on carbon emissions - Providers that meet stricter climate targets may win contracts from multinational brands with ESG mandates.

Prologis has already pledged a 40% reduction in carbon intensity by 2030, positioning it to stay ahead of regulatory curves. Competitors that lag may see market share erosion despite current size.

Which company is the biggest warehouse operator in the world?

As of 2025, Prologis holds the top spot, managing over 1.1 billion square feet of rentable space across six continents.

How do analysts rank warehouse companies?

They look at revenue, total square footage, number of facilities, and geographic reach. Public filings and third‑party market reports provide the raw numbers.

Is size the only factor when choosing a warehouse partner?

No. Technology, tenant mix, sustainability credentials, and pricing flexibility are equally important for long‑term success.

What are the fastest‑growing warehouse firms?

GLP and DHL Supply Chain have shown double‑digit growth in square footage over the past three years, driven by e‑commerce expansion in Asia and Europe.

How does automation affect warehouse size needs?

Automation can increase throughput by 30‑50% per square foot, meaning a company may need less physical space to handle the same volume of orders.