Is Uber a logistics company? Here's what really powers its delivery network

Logistics Model Comparison Calculator

Delivery Type

Comparison Results

Cost Estimate

$15.99

Cost Estimate

$27.50

Control Level

Medium

Control Level

High

Scalability

High

Scalability

Low

Based on 2024 industry data from the article. Surge pricing may increase Uber costs during peak hours.

When you order a burger through Uber Eats or ship a package with Uber Freight, it feels like you’re using a logistics company. But Uber doesn’t call itself one. So is it really? The answer isn’t yes or no-it’s messy, strategic, and tells you a lot about how modern delivery works today.

What Uber actually does

Uber started as a ride-hailing app. You open the app, tap a button, and a stranger in a sedan shows up to take you across town. That’s not logistics. That’s transportation on demand. But over the past five years, Uber added layers: food delivery, grocery pickup, package shipping, and even freight hauling for small businesses. Now, more than half of Uber’s revenue comes from these services, not rides.

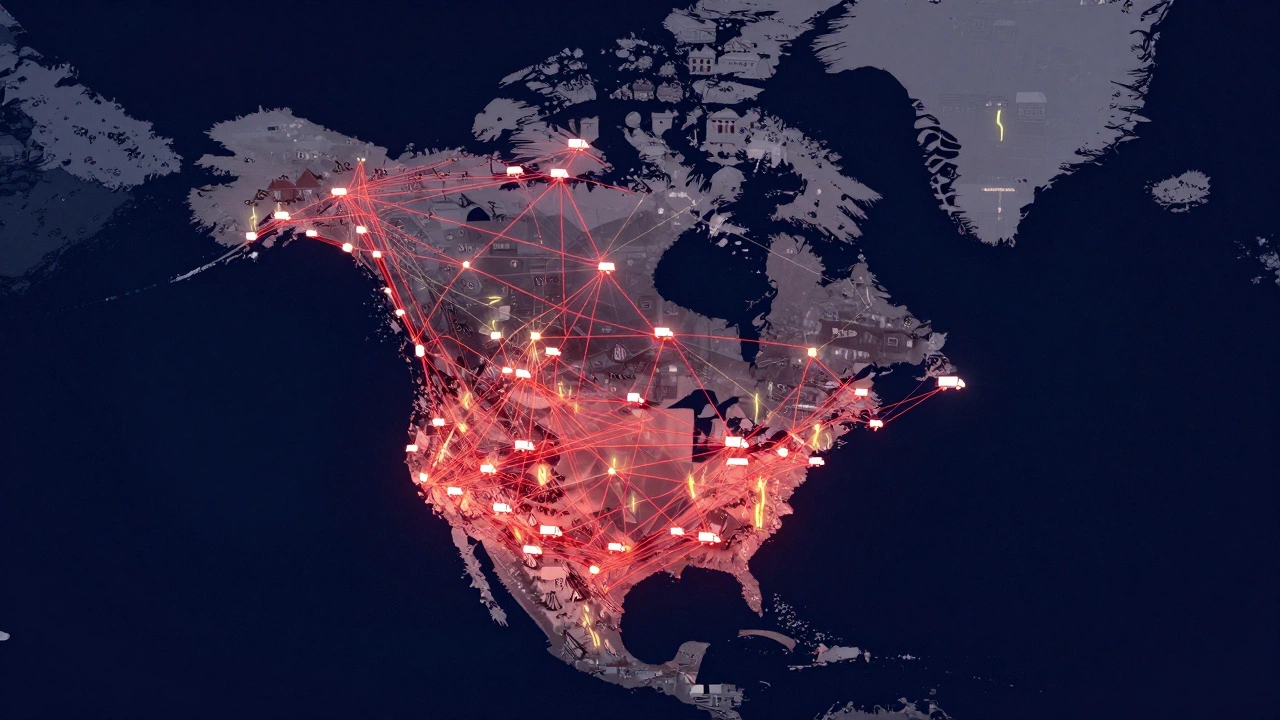

In 2025, Uber Eats delivered over 4.2 billion meals globally. Uber Freight moved more than 1.1 million truckloads across North America. That’s not a side hustle-it’s infrastructure. These aren’t just apps. They’re networks of drivers, warehouses, restaurants, and warehouses working together in real time. That’s logistics.

How logistics companies work

Traditional logistics companies like DHL, FedEx, or UPS own assets: trucks, planes, sorting centers, warehouses. They control the entire chain-from pickup to delivery. They plan routes, manage inventory, handle customs, and guarantee delivery windows. Their value is in reliability and scale.

Uber doesn’t own any of that. It doesn’t have a single truck in its garage. It doesn’t run a warehouse. It doesn’t hire drivers as employees. Instead, it connects people who need something moved with people who have time and a vehicle. It’s a platform. A digital middleman. That’s called asset-light logistics.

The difference between owning and connecting

Think of it like Airbnb versus a hotel chain. Airbnb doesn’t own rooms. It connects hosts with guests. Uber doesn’t own vehicles. It connects drivers with riders and deliveries. Both are platforms. Both are scalable. But neither can guarantee the same level of control as a traditional operator.

That’s why Uber’s delivery times can be unpredictable. A driver might get stuck in traffic. A restaurant might run out of staff. A package might sit at a pickup point for hours because no driver is nearby. Traditional logistics companies have backup plans. Uber relies on volume. If one driver drops out, another shows up-because there are thousands nearby.

Uber Freight: the real logistics play

Uber Freight is where Uber most closely mimics a true logistics company. It matches shippers with truckers for long-haul freight. It negotiates rates, tracks shipments, and provides proof of delivery. It even handles electronic documentation for customs and invoices.

Small businesses that ship pallets across states use Uber Freight because it’s faster and cheaper than calling a freight broker. In 2024, Uber Freight processed over $5 billion in freight volume. That’s bigger than many regional logistics firms. But here’s the catch: Uber still doesn’t own the trucks. The drivers are independent contractors. The warehouse? Not theirs. The system works because of data, not ownership.

Why Uber doesn’t call itself a logistics company

Legally and financially, Uber avoids the label. Logistics companies face heavy regulations: safety inspections, driver hours, cargo insurance, labor laws. If Uber admitted it was a logistics company, it could be forced to classify drivers as employees, pay for benefits, and comply with shipping regulations that apply to carriers-not platforms.

By calling itself a tech company, Uber keeps flexibility. It can test new markets without the burden of compliance. If a city cracks down on food delivery drivers, Uber can pull out. If a state passes a law requiring minimum wages for couriers, Uber can adjust its algorithm instead of changing its business model.

So is Uber a logistics company?

Operationally? Yes. Uber moves goods and people across cities and states. It uses real-time data, dynamic routing, and massive networks to do it. It solves the same problems as FedEx or DHL-just differently.

Structurally? No. Uber doesn’t own the assets, doesn’t control the full chain, and doesn’t take responsibility for delays caused by third parties. It’s a matchmaker, not a carrier.

The real question isn’t whether Uber is a logistics company. It’s whether the old model still makes sense. In 2026, consumers don’t care if the delivery comes from a truck owned by a company or a car driven by someone using an app. They just want it fast, cheap, and on time. Uber delivers on that. And that’s what matters.

What this means for small businesses

If you’re a local bakery or online retailer, Uber Eats and Uber Freight give you access to delivery networks you could never afford to build. No need to hire drivers. No need to buy vans. No need to manage schedules. You pay per delivery, and Uber handles the rest.

But there’s a downside. You’re at the mercy of Uber’s pricing. Rates change daily. Surge pricing hits during lunch rush. If Uber raises its commission from 15% to 25%, your margins shrink. You have no contract. No loyalty. No say.

That’s why smart businesses use Uber as one option-not their only one. They also use local couriers, regional delivery services, or even in-house drivers for high-volume orders. Diversification protects them.

The future of delivery

Uber isn’t the only one doing this. DoorDash, Instacart, Amazon Flex, and even TikTok Shop are building similar networks. The trend is clear: the future of delivery isn’t owned by big corporations. It’s built on apps, algorithms, and independent workers.

Logistics is becoming decentralized. The companies that win won’t be the ones with the most trucks. They’ll be the ones with the best software, the most drivers, and the clearest value for both customers and providers.

Uber may never call itself a logistics company. But if you’re waiting for a package, ordering dinner, or shipping a pallet-you’re already using one.

Is Uber Eats considered a logistics service?

Yes, operationally. Uber Eats connects restaurants with customers using a network of drivers to deliver food. It handles pickup, routing, timing, and payment-all core functions of logistics. But since Uber doesn’t own the food, the restaurant, or the driver, it’s a platform-based logistics model, not a traditional one.

Does Uber own any delivery vehicles or warehouses?

No. Uber doesn’t own vehicles, warehouses, or delivery centers. All drivers and delivery personnel are independent contractors using their own cars, bikes, or scooters. Warehouses are owned by restaurants, grocery stores, or third-party partners. Uber’s value is in its software, not its assets.

How is Uber Freight different from traditional freight companies?

Uber Freight uses an app to match shippers with independent truckers, similar to how Uber Eats matches drivers with orders. Traditional freight companies like XPO or Schneider own fleets, employ drivers, manage terminals, and handle customs directly. Uber Freight doesn’t. It’s faster to scale and cheaper to operate, but offers less control over delivery timelines and conditions.

Can Uber replace FedEx or UPS for business shipping?

For small, local, or time-sensitive deliveries-yes. For heavy, long-distance, or regulated shipments-no. Uber Freight works well for pallets under 1,000 lbs across regional routes. But for international shipping, hazardous materials, or guaranteed next-day delivery, traditional carriers still have the infrastructure and compliance systems Uber lacks.

Why do some people say Uber isn’t logistics at all?

Because logistics traditionally means owning and managing the full supply chain. Uber doesn’t own anything. It’s a tech platform that connects supply and demand. Critics argue that if you don’t control the assets, you’re not in logistics-you’re in tech-enabled brokerage. The debate hinges on how you define the word.